Is Retirement Dead?

By Joel Pozen

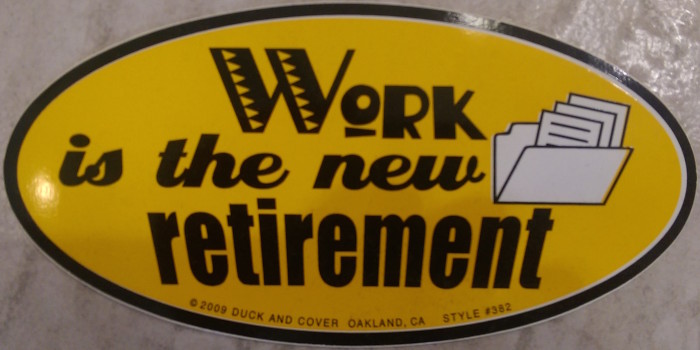

I was recently in Ft Myers Beach, FL (a beautiful place to be in the winter months, by the way) and I saw something that really caught my attention. I was just wandering through your typical beach town gift shop while my wife picked up a few token items for some family members back home. Then, I saw this…

Now I bet most people who looked at the stickers didn’t give this one a second thought. Heck, I bet a lot of you are wondering what the big deal is. It’s just a joke, after all. But part of what makes any joke funny is its element of truth to which everyone can relate.

Now I bet most people who looked at the stickers didn’t give this one a second thought. Heck, I bet a lot of you are wondering what the big deal is. It’s just a joke, after all. But part of what makes any joke funny is its element of truth to which everyone can relate.

Unfortunately, working until your final days on Earth, or until you absolutely no longer have the mental or physical capacity to do so is a new reality for many people. Working is in fact their retirement, and that’s not funny.

So what are you planning for your retirement? Do you have money in a 401(k) or IRA? You’re invested the way the so-called experts have told you to invest, so you’ll be fine, right? Maybe not.

The reason? High fees.

Any fees or costs associated with the funds you hold in your retirement accounts will eat away at your returns. Instinctively, you already know this – it just makes sense. You may not know, however, just how dramatic that effect can be.

The average cost of owning a mutual fund is 3% per year, according to Forbes. If you’re holding it in a taxable account or 401(k) then that average jumps to more than 4% per year. That doesn’t sound like very much on the surface, but take a look at what that does to your account value over a long period of time.

In his latest book, MONEY: Master The Game, Tony Robbins dives into this issue in depth. We’ll use one of his examples to illustrate the point.

The Drastic Effect of Fees

Let’s take 3 people who invest $1 million dollars over 30 years. They all receive the same 8% annualized return but Person 1 has annual fees of 3%, Person 2 has fees of 2%, and Person 3 has fees of 1%. At the end of 30 years, here’s what everyone has in their respective accounts:

Person 1: $4,321,942

Person 2: $5,743,491

Person 3: $7,612,255

A seemingly small difference of 2% in fees turns into a drastic increase of 76% in account value! Please take a minute and let that soak in… As Tony Robbins put it in his book, this can, “put hundreds of thousands, maybe even millions, back in your pocket,” and he clearly shows you how.

And if you’re thinking that this doesn’t apply to you, then check again. Really check. You might think your funds only have a fee of 1% or less, but make sure that isn’t just the cost of management, the Expense Ratio. Oftentimes, that’s the only expense many investors are aware of, but Forbes discusses several other hidden costs you need to look into. You can read all about them HERE.

Control Your Financial Future

Avoid actively-managed funds that try to beat the indexes. The more research and transactions occurring in your funds, the more it’ll cost you to be a part of them. Tony recommends Vanguard funds, which have a total cost of between 0.05% and 0.25%. Many exchange-traded funds (ETFs), such as the SPDR funds, are also cheaper than mutual funds.

Even better, take back control of your money altogether. If you invest in an employer-sponsored 401(k) then you might have very limited options within that account. That doesn’t mean you can’t also open your own self-directed IRA, or do trading/investing outside of a retirement account.

We here at BestTradingStrategiesRevealed.com advocate controlling your financial future instead of having someone else manage it for you. We teach you how to first protect your hard-earned money, then how to grow your wealth. Trading and investing for yourself is not as difficult, time-consuming, or as scary as it may seem. In fact, it can be quite simple if done the right way. We live it here everyday and can help make prosperity your new reality.

I sincerely hope working does not end up being your retirement. While it is for so many, it certainly doesn’t have to be. Something simple like effectively avoiding unnecessary fees and hidden costs can be the difference between retiring on-time and on-budget, and having to work an extra 10-15 years (or more). Check your accounts and make sure you’re headed down the right path.

To Your Prosperity!

P.S. – You should definitely read Tony Robbins’ book, MONEY: Master The Game. It’s certainly big (over 600 pages) but has a wealth (pun intended) of financial information from a variety of great sources. It blows some common misconceptions out of the water, and can almost assuredly make your life a little better and easier in any number of ways. Not to mention, the proceeds go to charity!