The Truth about Market Manipulation and How to Take Advantage of It

What is Market Manipulation? Market manipulation has existed for as long as there have been markets. Professionals use volume to inflate or deflate the price of a security for personal gain. This is called market manipulation or market merchandising. It is constantly carried on throughout the world markets. Those who control the markets for their […]

The Importance of Pattern Recognition in Trading

What if you could recognize the next great trade before the catalyst of that trade even occurred? What if I told you that trades like this happen repeatedly? What if you could recognize the next great trade before the catalyst of that trade even occurred? What if I told you that trades like this happen […]

4 Strategies Master Traders Use for Reading Trading Charts

Charting, or reading charts, is the practice of technical analysis that is performed through careful inspection of share price and volume data. It can help identify well-known data patterns that emerge in share prices. What is really being measured on the charts is not mass behavior in the marketplace but the techniques of the specialist […]

Is Retirement Dead?

Is Retirement Dead? By Joel Pozen I was recently in Ft Myers Beach, FL (a beautiful place to be in the winter months, by the way) and I saw something that really caught my attention. I was just wandering through your typical beach town gift shop while my wife picked up a few token items […]

The Only Question That Matters

The Only Question That Matters By Joel Pozen Success is complicated, isn’t it? I mean, what is success anyway? How do you measure it? You certainly can’t determine if you’re successful if you have no definition or means of quantifying it. Ugh, a few short sentences in and I’ve already made my own head […]

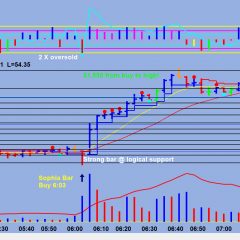

$1,550 Off the Oil Open

$1,550 Off the Oil Open By Joel Pozen That is how far price moved from the open of the buy bar to the high. The bar opened on its low so a $20 stop held. Beyond textbook asymmetrical risk. Even pun intended – you better be laughing and smiling – using our $80 stop the […]